does oklahoma have an estate or inheritance tax

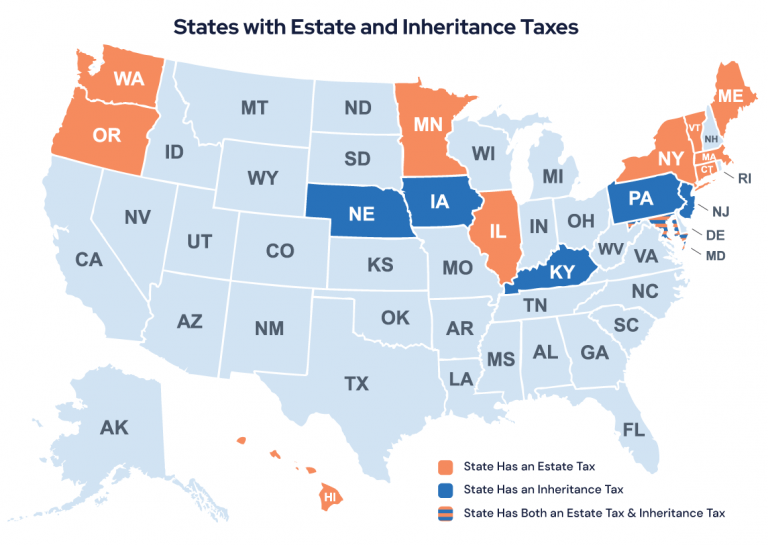

Eleven states have only an estate tax. Impose estate taxes and six impose inheritance taxes.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax.

. Oklahoma does not have an inheritance tax. The states with no state estate tax as of January 1 2020 are Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Idaho Indiana Iowa Kansas Kentucky Louisiana Michigan Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico North Carolina North Dakota Ohio Oklahoma Pennsylvania South Carolina South. What is meant by probating an estate.

The estates personal representative or executor is responsible for filing the necessary documents with the Internal Revenue Service IRS and for paying any tax that might be owed. The state with the highest maximum estate tax rate is Washington 20 percent followed by eleven states which have a maximum rate of 16 percent. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. 4 The federal government does not impose an inheritance tax.

Twelve states and Washington DC. Estate taxes and inheritance taxes. Maryland is the only state to impose both.

California does not have an inheritance tax estate tax or gift tax. In some cases however there are still taxes that can be placed on a persons estate. Maryland and New Jersey have both.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. How Do State Estate And Inheritance Taxes Work Tax Policy Center Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys Here S Which States Collect Zero Estate Or Inheritance Taxes States With No Estate Tax Or Inheritance Tax Plan Where You Die Calculating Inheritance Tax Laws Com. The top estate tax rate is 16 percent exemption threshold.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. States Without Death Taxes. Technically speaking there is no federal inheritance tax but there is a federal estate tax.

117 million increasing to 1206 million for deaths that occur in 2022. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. Connecticut Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island Vermont and Washington.

Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The top inheritance tax rate is 15 percent no exemption threshold.

Upon the death of a property owner Oklahoma law provides for a legal process to take control of the deceased owners probate assets assess their value pay creditors and distribute the assets to the persons legatees if the person died with a will or heirs if the person died without a will. Lets cut right to the chase. No estate tax or inheritance tax Oregon.

Hawaii and Delaware have the highest exemption. Such procedures take place in the district court. Very few people now have to pay these taxes.

A federal estate tax is in effect as of 2021 but the exemption is significant. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax. Currently fifteen states and the District of Columbia have an estate tax and six states have an inheritance tax.

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Estate And Inheritance Taxes Itep

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Is There A Federal Inheritance Tax Legalzoom Com

Estate And Inheritance Tax State By State Housing Gurus

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Calculating Inheritance Tax Laws Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Iowa Estate Tax Everything You Need To Know Smartasset

States You Shouldn T Be Caught Dead In Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Need To Pay Inheritance Taxes Postic Bates P C

Indiana Estate Tax Everything You Need To Know Smartasset

State Taxes For Retirees Social Security Pensions Military

Oklahoma Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Inheritance Tax Here S Who Pays And In Which States Bankrate